JPMorgan Chase Bank is paying the price for its role as the banker for Bernard Madoff’s multi-billion dollar Ponzi scheme.

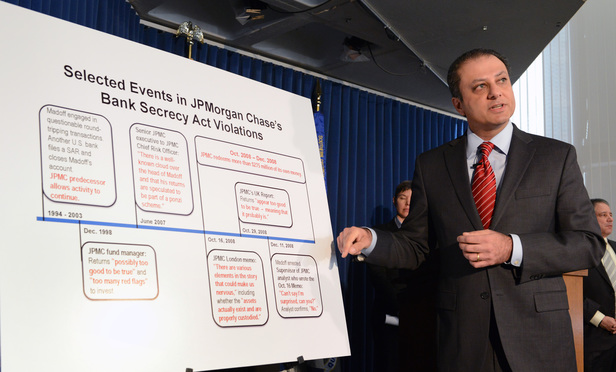

The nation’s largest bank and Southern District U.S. Attorney Preet Bharara on Tuesday announced a $1.7 billion forfeiture and a two-year deferred prosecution agreement for violating two counts of the Bank Secrecy Act—a settlement Bharara hailed as sending a critical message about compliance to banks on reporting requirements (See Agreement).