In estate planning, this year has been one of uncertainty as we all wait to see if there will be the anticipated changes to income and estate tax rates. In this climate, practitioners have utilized some creative solutions, which also provide flexibility in the face of uncertainty.

While the creation of trusts may have significant tax savings, many clients remain concerned about giving up control to one trustee. Directed trusts have become increasingly popular with clients for precisely this reason. A settlor of a trust can scatter responsibilities (and liabilities) among several individuals or entities, without having multiple trustees. This can be particularly appealing when planning with closely-held businesses and succession planning.

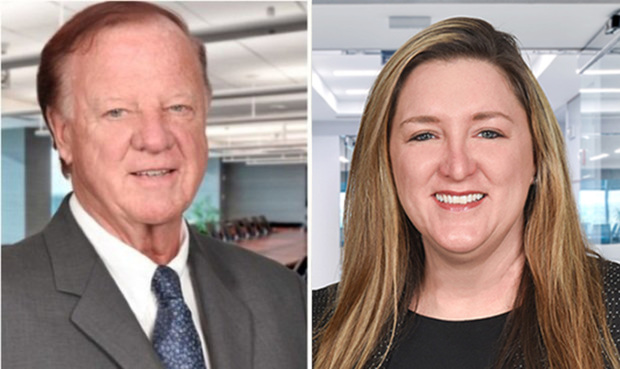

C. Raymond Radigan and Jennifer F. Hillman

C. Raymond Radigan and Jennifer F. Hillman