Many of us have joint bank accounts, and have clients who own joint bank accounts. Joint accounts can be useful in many instances, including where multiple parties want ownership of and access to the funds in the account (for example, spouses share a checking account or brokerage account), or where an elderly or infirm account owner wants assistance with bill pay, check writing or other banking functions (for example, a daughter is added to her mother’s checking account to pay mom’s monthly utility bills). While both of these scenarios are common, there is an important consideration for account owners and their estate planning attorneys—is the account in question truly a joint account, or is it merely a convenience account? While this may appear to be a simple question, this issue is ripe for litigation and frequently plays out in the courts after one of the account owners passes away.

Banking Law §675 provides that a “deposit of cash, securities, or other property … in the name of such depositor or shareholder and another person and in form to be paid or delivered to either, or the survivor of them, such deposit … shall become the property of such persons, as joint tenants … and may be paid or delivered to either during the lifetime of both or to the survivor after the death of one of them.” BL §675(a). The statute further provides that the making of such a deposit shall, “in the absence of fraud or undue influence, be prima facie evidence … of the intention of both depositors … to create a joint tenancy and to vest title to such deposit … and additions … in such survivor.” BL §675(b).

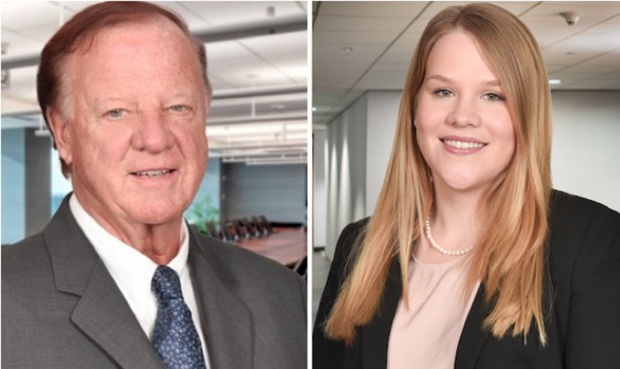

C. Raymond Radigan and Lois Bladykas

C. Raymond Radigan and Lois Bladykas