We are thrilled to celebrate with our mentor and colleague Mary B. (Handy) Hevener as she receives a well-deserved Lifetime Achievement Award from the New York Law Journal. Handy, a partner at Morgan Lewis, is a legendary employment tax lawyer whose legal prowess is known throughout corporate America and the legal profession, and even within the IRS. While shattering the glass ceiling in this male-dominated field, Handy has significantly shaped Federal employment tax policy. Handy’s passion for the legal profession—and in particular, payroll tax—first began at age 5, when she worked in her mother’s law office updating case portfolios. Through college and law school Handy worked as a payroll tax policy researcher at the Brookings Institute. Upon admission to the bar, Handy went to work as an attorney-adviser for the U.S. Treasury Department’s Office of the Tax Legislative Counsel, where she was instrumental in working with Congress and the IRS in passing sweeping legislation and Treasury regulations that for the first time codified exclusion rules for a dozen common employer-provided fringe benefits.

Handy and Morgan Lewis have been involved in more than half of the major employment tax audits and litigation involving big stakes and issues of first impression. Ask anyone who knows her, and Handy is a walking encyclopedia of employment tax matters, including payroll tax, fringe benefits, executive compensation, excise tax, and information reporting. Beyond assisting Fortune 10 through 500 companies and other clients, Handy has shared her employment tax expertise with numerous pro bono clients, helping reduce tax liability through the IRS audit, appeals, and collections processes.

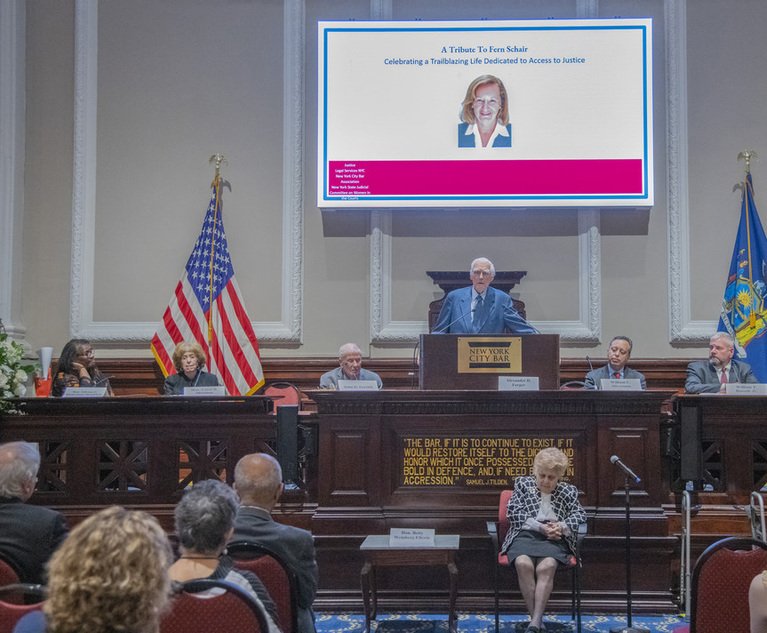

Mary Hevener, partner at Morgan Lewis & Bockius. Photo: Morgan Lewis

Mary Hevener, partner at Morgan Lewis & Bockius. Photo: Morgan Lewis