Bankruptcy reform is not a new topic. In 2005, the credit card industry secured the passage of The Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA), which not only transformed consumer bankruptcies, making them more difficult and costly for individuals, but had far-reaching impacts on commercial bankruptcies under Chapter 11, making business reorganizations more challenging. In 2011, the American Bankruptcy Institute (ABI) formed a Commission to Explore Overhauling Chapter 11.

The Commission’s recommendations, published after three years and weighing in at 402 pages, was comprehensive. In 2018, the commission’s co-chair presented its findings to a Senate judiciary subcommittee. And in 2019, the ABI’s Commission on Consumer Bankruptcy unveiled recommendations for making the bankruptcy system more accessible for both financially struggling Americans and the professionals who serve them. And… nothing much has happened since.

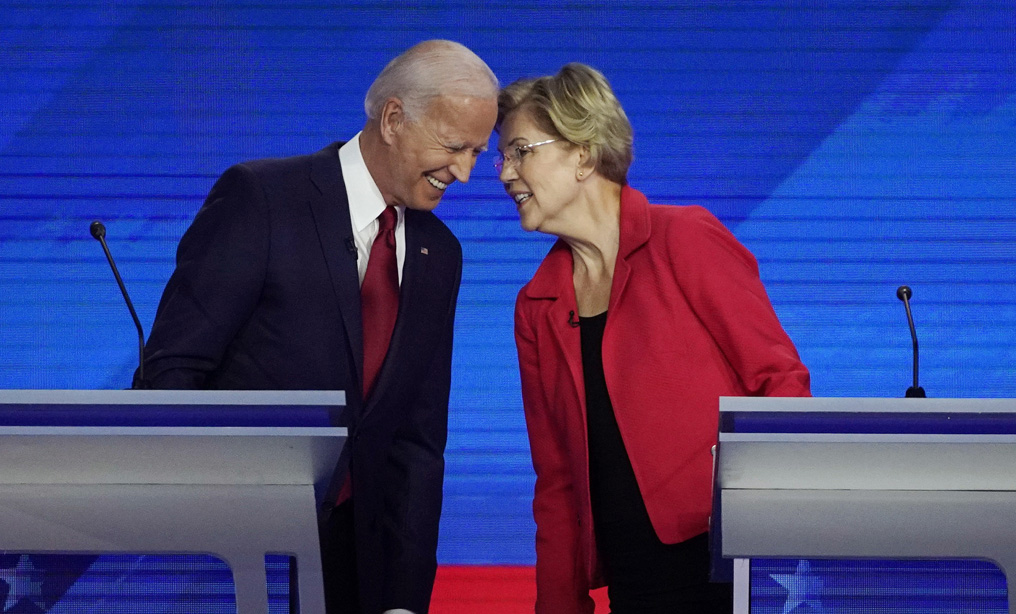

(AP Photo/David J. Phillip, File)

(AP Photo/David J. Phillip, File)