Acceleration in the context of mortgages is nothing more than a contractual remedy. It is a contractual remedy that springs from a debtor’s uncured default of a term mortgage loan and affords the mortgagee—in lieu of waiting for the contractual maturity date to occur—the right to seek an immediate payment in full of the underlying debt. Once the whole amount of the mortgage debt is payable in full, then, generally, the mortgagee has the right to bring a suit for the whole amount of the debt or bring a suit seeking full foreclosure (as distinguished from partial foreclosure (see RPAPL §1351(2)).

Acceleration is not a common law principle or doctrine. As a contractual remedy, the particulars of how acceleration is achieved is determined wholly by the express terms of the mortgage. It is axiomatic under New York precedent that “if the agreement on its face is reasonably susceptible of only one meaning, a court is not free to alter the contract to reflect its personal notions of fairness and equity,” Greenfield v. Philles Records, 98 N.Y.2d 562, 569-570, 780 N.E.2d 166 (2002). Furthermore, the Court of Appeals in Graf v. Hope Building Corp., 254 N.Y. 1, 4, 171 N.E. 884 (1930) cautioned: “[the court is] not at liberty to revise while professing to construe.”

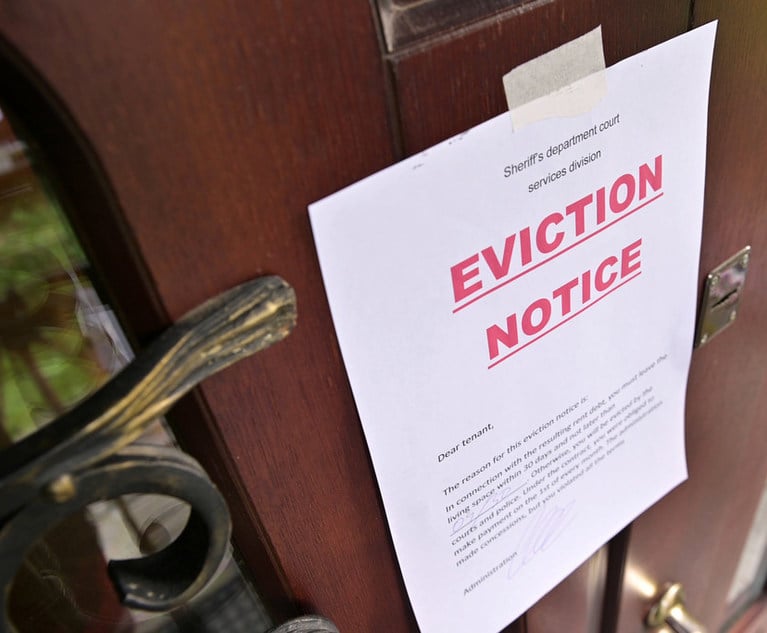

Francis Caesar. Courtesy Photo

Francis Caesar. Courtesy Photo