On March 27, 2020, shortly after Gov. Andrew Cuomo adopted shelter-in-place mandates in New York, the Legislature introduced Assembly Bill No. A10226. This proposed legislation, if enacted, would broadly extend an insurance policy’s business interruption coverage to cover losses sustained “due to the coronavirus disease 2019 (COVID-19).” The deep-pocketed insurance industry—with their powerful lobbying groups vociferously opposing the legislation on constitutional grounds for violating the contracts clause of the U.S. Constitution—likely stand on firm legal footing since the Legislature is effectively attempting to rewrite the parties’ insurance contracts by extending coverage beyond the areas explicitly covered under the original policy language.

Although there was clamor for the bill in Albany when it was first introduced on the State Assembly floor, it has been languishing in committee for nearly two months now and appears to have run out of steam. Without the Legislature interjecting sweeping coverage to COVID-19 related insurance claims, the courts will be charged with shaping insurance coverage issues going forward on an ad hoc basis. While insurance companies are breathing a sigh of relief, local government in New York City has adopted more recent legislation adversely impacting commercial landlords by abolishing personal guarantees that were used at lease inception, to induce those landlords to enter into those leases. Based upon longstanding legal precedent, this legislation could be found to be facially invalid on constitutional grounds.

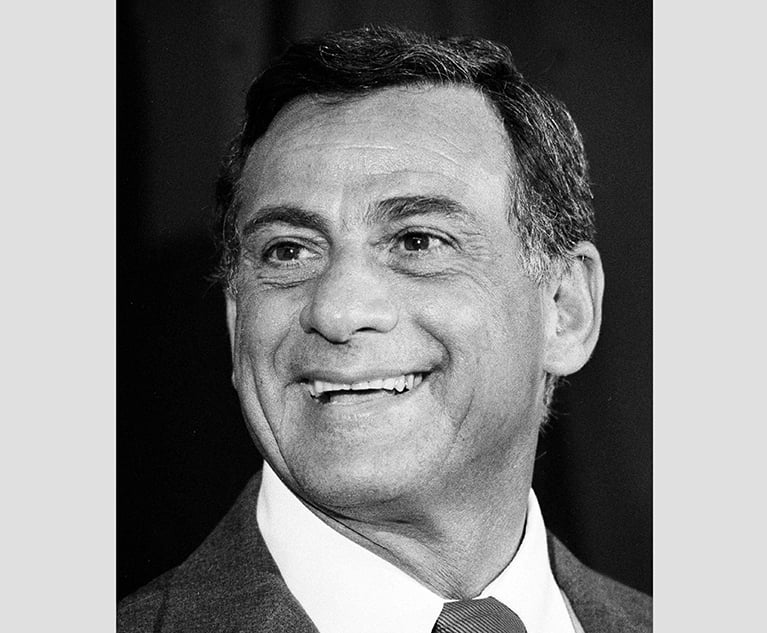

Massimo D’Angelo

Massimo D’Angelo