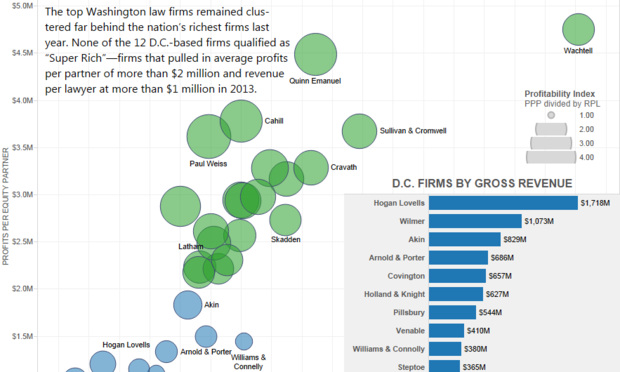

The top Washington law firms remained clustered far behind the nation’s richest firms last year, according to a financial survey released by NLJ affiliate The American Lawyer. None of the 12 Washington-centered firms qualified as “Super Rich” — the magazine’s term for firms that pulled in average profits per partner of more than $2 million and revenue per lawyer at more than $1 million in 2013.

Most such firms were based in New York and posted profits per partner closer to $3 million. All but one of the D.C.-centered firms’ profits per partner ranged between $900,000 and $1.5 million. (In this analysis, New York-centered and Washington-centered firms are designated according to the city hosting their largest U.S. office.)