While pundits have predicted a recession in the United States for well over a year, the U.S. economy has been growing at a steady clip since the third quarter of 2020. Following historical stimulus programs to bring the economy out of a pandemic-induced trauma starting in March 2020, culminating in the falsely named “Inflation Reduction Act” of 2022, inflation reached double digits. Unemployment is at record lows, and labor markets remain stubbornly tight. The Federal Reserve has been coordinating a historic tightening of monetary policies, raising interest rates by 500 basis points in less than a year, while shrinking its balance sheet and ending “quantitative easing” as we knew it.

Unsurprisingly, asset allocation has moved away from equity and other high-risk products given the higher cost of capital, and into higher returning debt products. This translated into a 20% fall in the S&P 500 in 2022. Also, the Dow Jones US Technology Index and NASDAQ fell by 35% and 33%, respectively, in 2022. Year to date in 2023, the stock market has been relatively flat, and the market for new issues has been tightly shut.

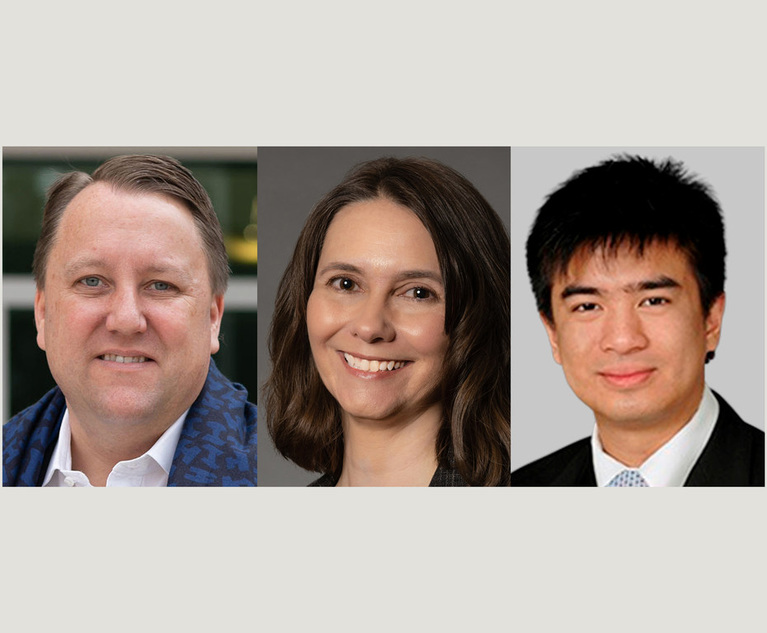

(L-R) Louis Lehot, Brandee Diamond and Eric Chow, partner with Foley & Larder. Courtesy photos

(L-R) Louis Lehot, Brandee Diamond and Eric Chow, partner with Foley & Larder. Courtesy photos