A subtle but interesting issue for white-collar lawyers is the tax treatment of settlement payments to resolve government investigations. Proposed regulations would treat the disgorgement of profits as nondeductible. Recent Supreme Court guidance, however, makes the IRS’s position susceptible to challenge. And new documentation and IRS reporting requirements will require settling agencies to engage on these tax issues.

Deductibility of Government Settlement Payments

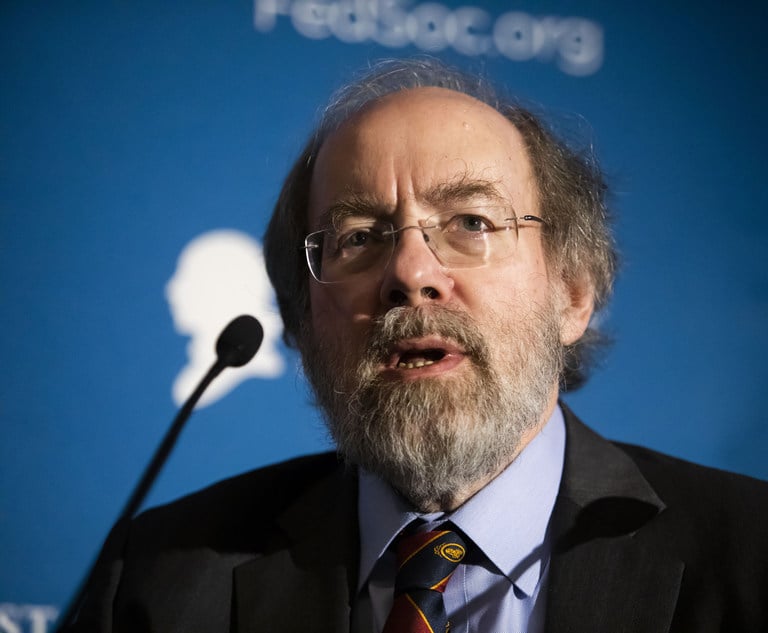

U.S. Internal Revenue Service in Washington, D.C. Photo: Mike Scarcella/ALM

U.S. Internal Revenue Service in Washington, D.C. Photo: Mike Scarcella/ALM