Last June, in this space, I authored a column about Pennsylvania law on substantive and procedural aspects of piercing the corporate veil of companies to reach the assets of their shareholders or the assets of a parent company in corporate groups. In early January 2020, I wrote a column about the development of Pennsylvania law on establishing personal jurisdiction over registered nonresident businesses since the Supreme Court’s decisions in. In this case, I address the intersection of those two related columns in cases involving corporate groups. That is, when nonresident members of a corporate group, usually the parent company, should expect to be subjected to the jurisdiction of Pennsylvania courts when one of the entities, usually the subsidiary, is based or does business in the state.

The courts in Pennsylvania subject a nonresident parent corporation to their jurisdiction if they find that the Pennsylvania subsidiary is the “alter ego” of the parent. The alter ego theory is one of the theories of piercing the corporate veil under which control is the key in foregoing the separate legal entity in a group. Under the alter ego theory, the courts evaluate the level of control asserted by the parent company in their considerations of whether to pierce the corporate veil of the corporate group. See Miners v. Alpine Equipment, 722 A.2d 691, 695 (Pa.Super. 1998). In jurisdictional matters, the alter ego theory imputes the personal jurisdiction of the court over the subsidiary to its parent or the other way around. Alter ego jurisdiction is especially important for litigators because it enables them to bring their cases against the large out-of-state corporations, which use Pennsylvania-based subsidiaries as a mere instrument of doing their business in Pennsylvania to limit their liability.

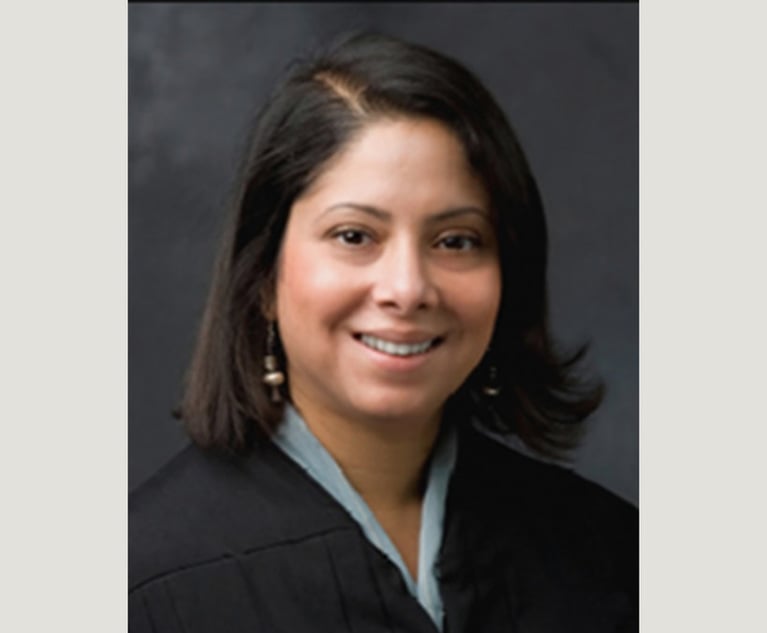

Edward T. Kang, Kang Haggerty & Fetbroyt

Edward T. Kang, Kang Haggerty & Fetbroyt