The Georgia Supreme Court had some tough questions on what responsibilities an insurer has to its policyholders facing potentially hefty liability and just how precise a plaintiff’s “Holt” settlement demand must be before an insurer is bound to respond.

The closely watched case centers on the use—and purported misuse—of time-limited settlement demands that insurers and defense lawyers say have evolved into “gotcha” bad-faith setups. Alston & Bird partner Andy Tuck, who argued on behalf of First Acceptance Insurance Company of Georgia during Tuesday’s arguments, said the demands are designed to “bust policy limits rather than settle the claims.”

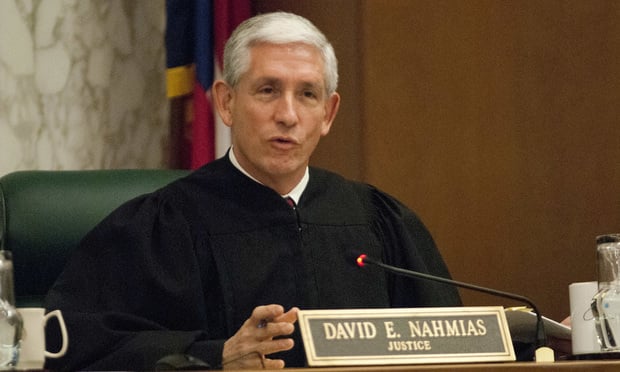

Presiding Justice David Nahmias. (Photo: John Disney/ALM)

Presiding Justice David Nahmias. (Photo: John Disney/ALM)