While the pace of the nation’s economic growth remains in the low single digits as the country slowly recovers from the Great Recession, Alston & Bird in the past two years has boosted its revenue and net income by nearly 20 percent.

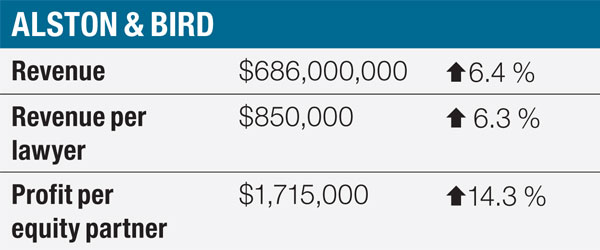

In 2012, Alston’s revenue rose, although the law firm’s rate of revenue growth was not as robust as in 2011. The firm reported revenue of $686 million in 2012up a healthy 6.4 percent from 2011and a net income of $245.5 million, up 7 percent.