A con man is exploiting a loophole in public records access to target South Florida real estate lenders and landowners.

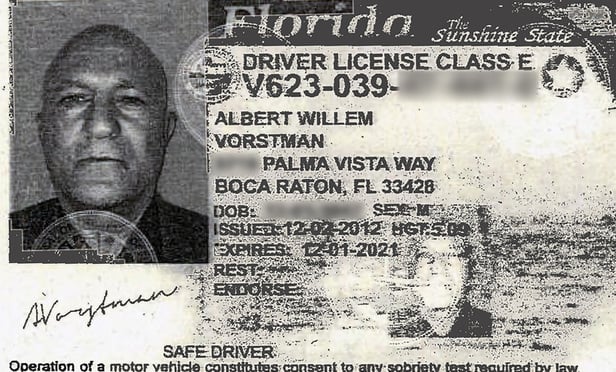

Based on little more than his charm, a fake driver’s license and forged corporate documents altered on a government-run website for $50, he posed as a Boca Raton doctor and walked away with $550,000 from hard-money lenders in Fort Lauderdale.