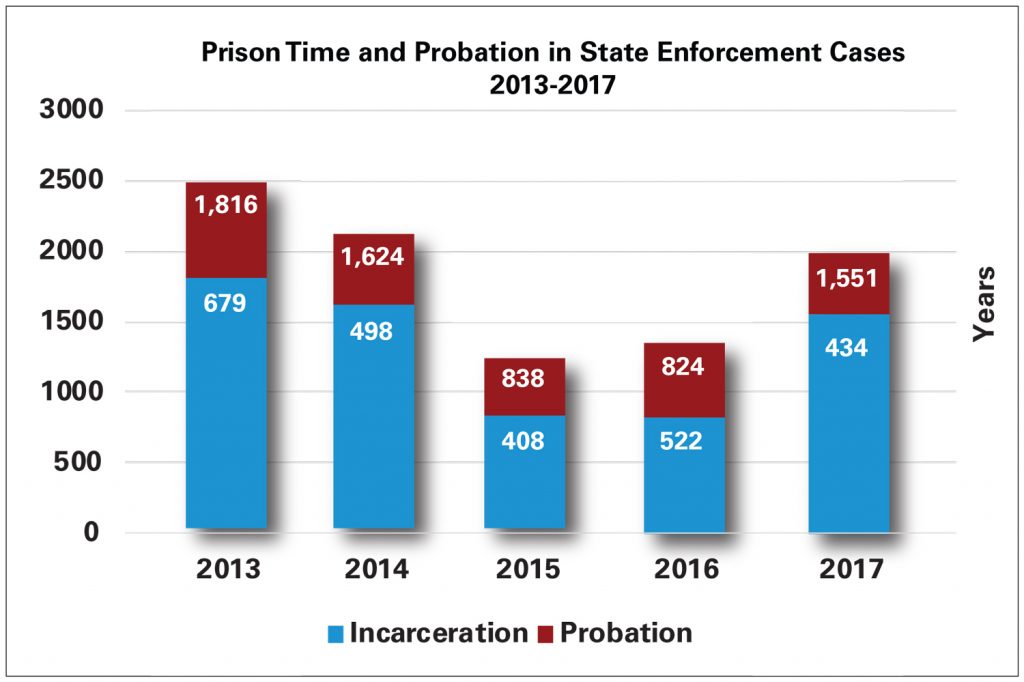

State securities regulators brought enforcement actions last year resulting in 1,985 years of prison time and probation, a 47% increase over the prior year, with actions against advisors outnumbering those against broker-dealers.

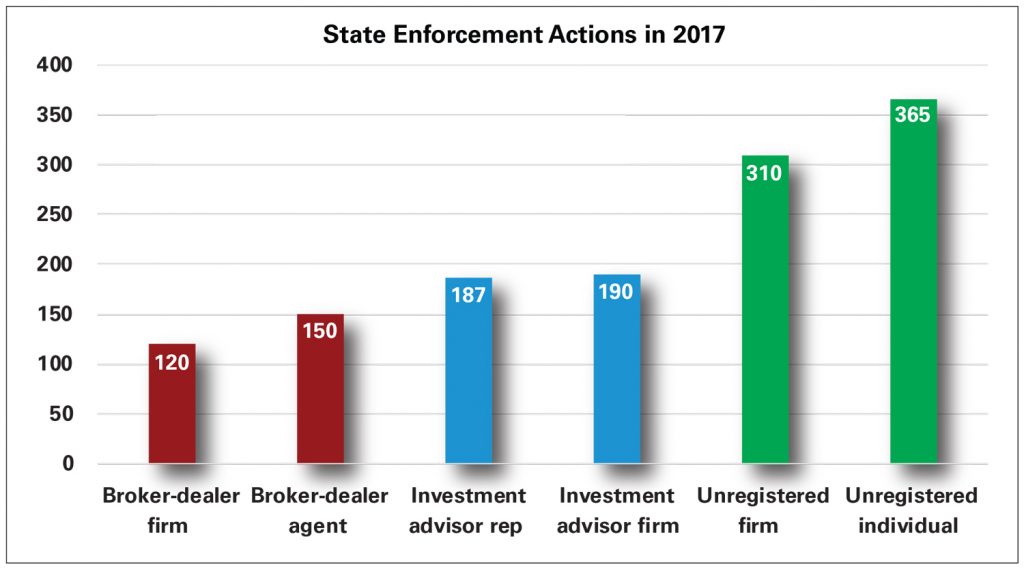

The North American Securities Administrators Association’s just-released annual enforcement report on 2017 data found that state securities regulators took more actions against unregistered individuals and firms in 2017, reversing a two-year trend in cases against registered individuals.

The 51 NASAA jurisdictions brought more enforcement actions against unregistered firms and individuals (675 actions) compared to registered individuals and firms (647 actions).

In total, state securities regulators commenced 4,790 investigations in 2017, a 10% increase over the prior year, and initiated 2,105 enforcement actions, a nearly 6% increase.

These actions led to more than $486 million in restitution ordered returned to investors, fines of $79 million and criminal relief of 1,985 years, including incarceration and probation.

Source: NASAA

Source: NASAA

“The results from this year’s enforcement survey demonstrate that state securities regulators continue to play a critical role in protecting investors and holding securities law violators responsible for the damage that they cause to individual investors specifically and to the integrity of our capital markets in general,” said Michael Pieciak, NASAA president and Vermont Commissioner of Financial Regulation, in a statement.

Pieciak attributed the increase in enforcement against unregistered firms or individuals, in part, to an increased focus on fraudulent initial coin offerings and other crypto-assets and the growing enactment of state legislation based on, or inspired by, NASAA’s Model Act to Protect Vulnerable Adults from Financial Exploitation.

The report also notes that 2017 was the first year in which investment advisor firms and representatives significantly outnumbered broker-dealer firms and agents as respondents in state enforcement actions. NASAA took 377 enforcement actions against advisors and 270 against BDs.

Over the period from 2014 to 2016, NASAA U.S. members reported taking actions against roughly an even number of BD firms and agents (1,050 total) and IA firms and representatives (982 total).

The list of “schemes and products involved” includes indexed annuities and variable annuities, as well as unregistered securities, traditional securities, viaticals, senior designations, free lunch seminars and affinity fraud.

— Related on ThinkAdvisor:

- FINRA’s Top 5 Fine Categories in First Half of 2018

- ‘Heightened Supervision’ Plans Are a Must for BDs: NASAA

- Advisor Sentenced to Over 6 Years in Prison: Enforcement

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

Source: NASAA

Source: NASAA