Crowell & Moring offices in Washington, D.C. Jan. 29, 2015. Photo by Diego M. Radzinschi/ALM.

Crowell & Moring offices in Washington, D.C. Jan. 29, 2015. Photo by Diego M. Radzinschi/ALM.

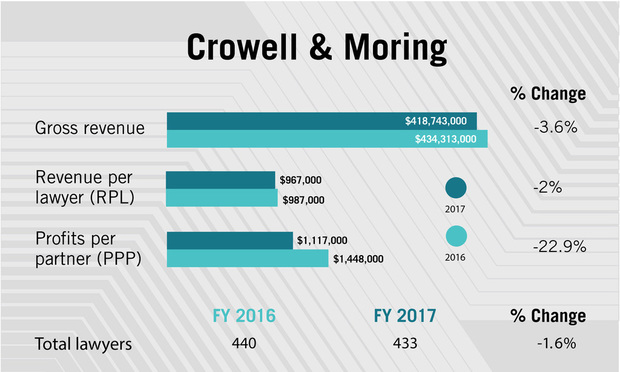

Crowell & Moring saw its revenue slip 3.6 percent in 2017, to $418.7 million, while a significant decline in net income from a blockbuster 2016 depressed average profits per partner by 22.9 percent, to $1.17 million, preliminary figures show.

Revenue per lawyer slipped two percentage points to $967,000, as total lawyer head count inched down 1.6 percent to 433. The size of the partnership remained roughly unchanged, with 97 equity partners and 80 partners classified as nonequity last year.

With profits down nearly a quarter from 2016, you might expect Crowell & Moring to be lamenting what looks like a dismal year. But firm chair Phil Inglima pointed out that the firm has actually seen double-digit growth in both PPP and revenue per lawyer when measured over the last five years.

“We definitely felt we finished very strong,” Inglima said of the 2017 results. “For perspective, 2016 was our biggest year ever by quite a lot, 2017 was our second-biggest year ever, and in both years we far exceeded our own internal expectations. And the reality is it’s hard to keep up that level of performance every year but we did certainly exceed our expectations both years.”

Data provided by the firm shows its revenue per lawyer up nearly 18 percentage points since 2014, and climbing more than 27 percentage points from 2012. Profits per equity partner also rose nearly 21 percentage points in the previous five years, and jumped nearly 8.5 percentage points in the past three years. (These percentages reflect an updated, more accurate ALM and American Lawyer rounding method that may differ from previous years.)

Crowell & Moring financial infographic.

Crowell & Moring financial infographic.

Responding to the mismatch in revenue and profits in 2017, with profits down much more sharply, Inglima said contingency revenues had been a “significant driver” of some of the firm’s recent growth. He declined to say what percentage of revenue in 2016 and 2017 came from contingency matters versus billable-hour work.

Inglima also pointed to changes to its compensation—particularly for associates—and a “slight cost impact” from San Francisco real estate expenses as causes for the profit slide. The firm increased its baseline compensation for associates last year, Inglima said, and a larger bonus pool was triggered as the result of attorneys hitting their marks.

“There were greater compensation expenses at the nonpartner level; part of it driven by our revised compensation system over the last year,” Inglima said. “[T]o the extent that you’re looking for big drivers of new expenses, it’s not like there was a significant single hit of any kind that would move it in a big way.”

Nonequity partner compensation expenses rose 1.1 percentage points at Crowell & Moring in 2017, according to preliminary figures from the firm.

When it comes to personnel, the biggest change at Crowell & Moring last year came in its top leadership. Crowell & Moring voted to install Inglima as chair in place of Angela Styles, then a government contracts partner in Washington, last fall.

Inglima refused to discuss whether the firm’s 2017 financial results factored into the partners’ decision to change leadership, and he said he would not comment on the context or terms of Styles departure. After being voted out of leadership, Styles exited before the end of her term and joined Bracewell as a government contracts partner in October 2017.

Last year’s changes did result in fewer women in positions of power, and the firm has taken note. Inglima said the partners are “are really prioritizing diversity” as it undertakes its next leadership elections.

He said Crowell & Moring is also anticipating several other changes in 2018, including ambitions to grow on the West Coast and in New York.

Despite Crowell & Moring’s failed merger efforts with New York-based firms Satterlee Stephens and Herrick Feinstein in recent years, Inglima said his firm “certainly” has growth aspirations in New York that extend beyond regular lateral hires.

“We do believe growth continues to be an important strategy in New York, and that we’re going to have to be looking beyond our walls to do that,” Inglima said. “We’re quite eager to find opportunities to grow in an effective and consistent way in New York.”

Inglima said he expects incremental growth in the firm’s San Francisco and Los Angeles markets that will take priority over adding lawyers to its D.C., London and Brussels offices in 2018. Crowell & Moring shuttered its Anchorage, Alaska, outpost in 2017.

In addition to its geographical growth plans, he said Crowell & Moring expects business to boom in its investigations’ business.

“We have invested a lot in the acquisition of more talent for investigations, mostly in the white-collar group but across other groups as well,” Inglima said. “We conduct investigations out of many of our regulatory practices, and so we have been pushing out more and more of that offering to the clients, and to good effect so far.”

In analyzing the legal market more broadly, Inglima said that despite a rapidly consolidating marketplace, Crowell & Moring has no plans for a large-scale merger and is not looking to be acquired by a larger firm.

“We’re on a growth trajectory that’s going to continue, and we don’t fix a specific ambition to that,” Inglima said.

“We know that it is in our interest to continue deepening our strong practice offerings, and that it is important that in every market where we choose to be that we choose to be in a meaningful way,” he added. “We want to have business generated from clients local to that market as well as national to the firm in every one of our locations.”