A key witness in a criminal case over the 2012 collapse of Dewey & LeBoeuf told a Manhattan jury March 10 that he facilitated improper accounting adjustments and took steps to hide them from auditors after discussing the adjustments with former Dewey CFO Joel Sanders.

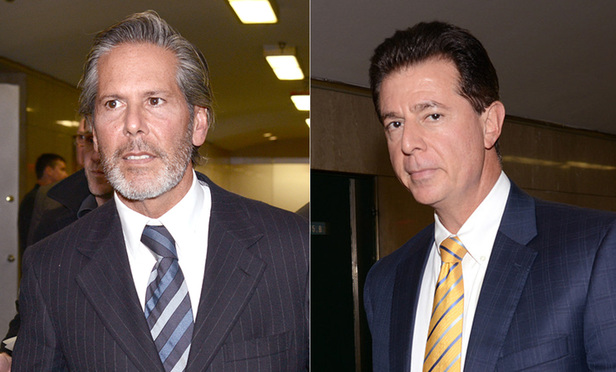

In his second day on the stand in the retrial of criminal charges against Sanders and former Dewey executive director Stephen DiCarmine, former Dewey finance director Francis Canellas detailed various accounting adjustments he said the firm made in late 2008. He testified that intentional inaccuracies were included in a 2009 and 2010 balance sheet that the firm submitted to financial auditors at Ernst & Young.