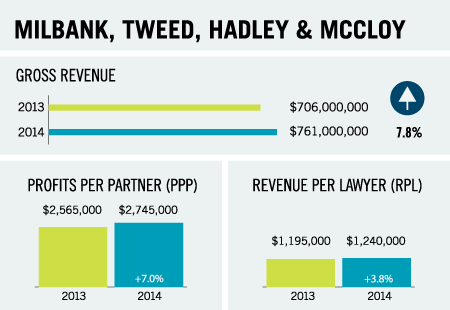

For the second straight year, Milbank, Tweed, Hadley & McCloy produced significant growth in revenue and profits. Gross revenue in 2014 was up 7.8 percent, to $761 million, while revenue per lawyer rose 3.8 percent, to $1.24 million. Profits per partner increased 7 percent, to $2.745 million, on net income of $395 million, an increase of 12.4 percent.

The firm’s head count increased 3.7 percent, to 614 lawyers, and the number of equity partners rose from 137 to 144. Meanwhile, the firm’s small class of nonequity partners dropped from 13 to eight, and nonequity compensation fell from $16 million to $7.5 million.

The firm’s head count increased 3.7 percent, to 614 lawyers, and the number of equity partners rose from 137 to 144. Meanwhile, the firm’s small class of nonequity partners dropped from 13 to eight, and nonequity compensation fell from $16 million to $7.5 million.