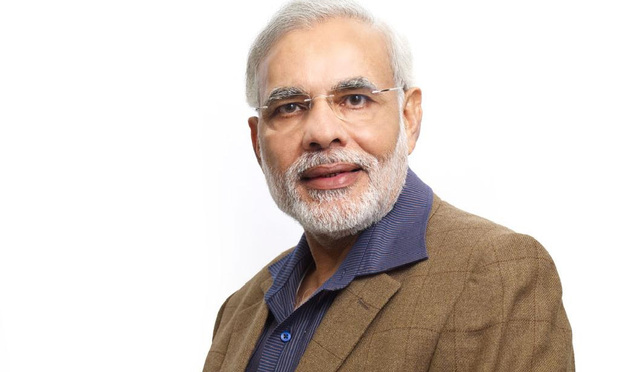

In May, a record voter turnout in India made Bharatiya Janata Party candidate Narendra Modi the country’s new prime minister and cast aside the Congress Party’s Manmohan Singh, who was blamed for an ailing economy and a spate of corruption scandals.

For the Indian electorate, the election results produced a collective sigh of relief. To law firms, it was a chance to see a long-awaited uptick in business.