» back to Atlanta Firm Financials homepage

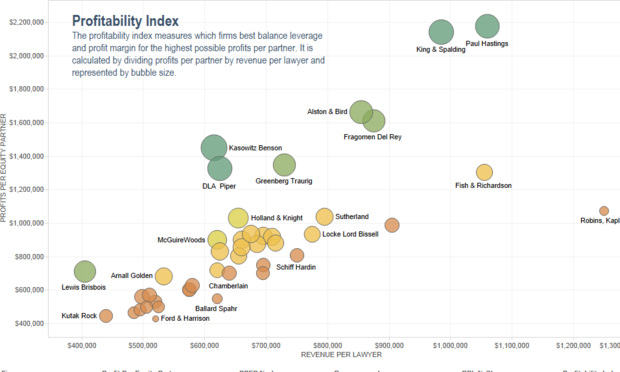

Despite the flat demand for legal services, Atlanta’s largest firms fared pretty well last year.

Despite the flat demand for legal services, Atlanta's largest firms fared pretty well last year.

April 28, 2014 at 12:00 AM

1 minute read

» back to Atlanta Firm Financials homepage

Despite the flat demand for legal services, Atlanta’s largest firms fared pretty well last year.

Presented by BigVoodoo

The Daily Report is honoring those attorneys and judges who have made a remarkable difference in the legal profession.

Law firms & in-house legal departments with a presence in the middle east celebrate outstanding achievement within the profession.

The premier educational and networking event for employee benefits brokers and agents.

A large and well-established Tampa company is seeking a contracts administrator to support the company's in-house attorney and manage a wide...

We are seeking an attorney to join our commercial finance practice in either our Stamford, Hartford or New Haven offices. Candidates should ...

We are seeking an attorney to join our corporate and transactional practice. Candidates should have a minimum of 8 years of general corporat...

MELICK & PORTER, LLP PROMOTES CONNECTICUT PARTNERS HOLLY ROGERS, STEVEN BANKS, and ALEXANDER AHRENS