The presiding judge who approved Equifax’s data breach settlement has ordered six objectors to post bond while they pursue appeals of the $1.4 billion deal.

U.S. District Chief Judge Thomas Thrash of the Northern District of Georgia on Monday ordered each of six individuals he called “serial objectors” to individually post a $2,000 bond within the next 14 days.

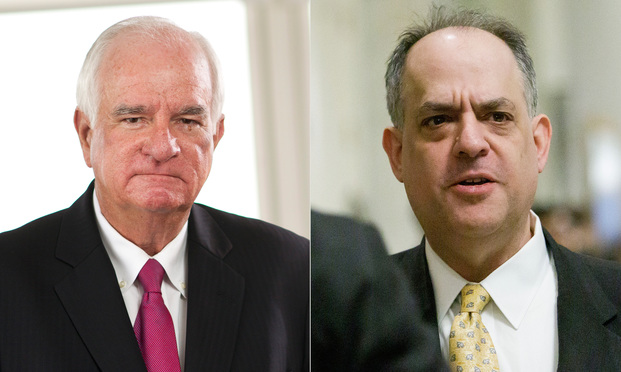

Judge Thomas Thrash and Ted Frank.

Judge Thomas Thrash and Ted Frank.