Fraudulent conveyance litigation arising from failed leveraged buyout transactions is frequently pursued in bankruptcy proceedings as the sole source of recovery for creditors. Targets of these actions typically include those parties who received the proceeds generated by the LBO, including the debtor’s former shareholders. However, until now, in many circuits these lawsuits were blocked by the safe harbor provisions contained within Section 546(e) of the Bankruptcy Code, if the proceeds of the challenged transaction flowed through a financial institution such as a bank, even if that bank was not otherwise materially involved in the deal. As a result of a very recent decision by the U.S. Supreme Court, that outcome has now changed in Merit Management Group v. FTI Consulting, 583 U.S. ____ (2018), 2018 U.S. LEXIS 1514.

In Merit, the Supreme Court held that a plain statutory reading of the safe harbor provisions within Section 546(e), requires a court to review the actual transfer sought to be avoided, and not just the use of intermediaries along the way. In other words, as the Supreme Court noted, in a transaction that involves transfers from A → B → C → D, where B and C are financial institutions, and the transfer the trustee seeks to avoid is the one from A → D, the fact that B and C are financial institutions will not in and of itself immunize the transaction.

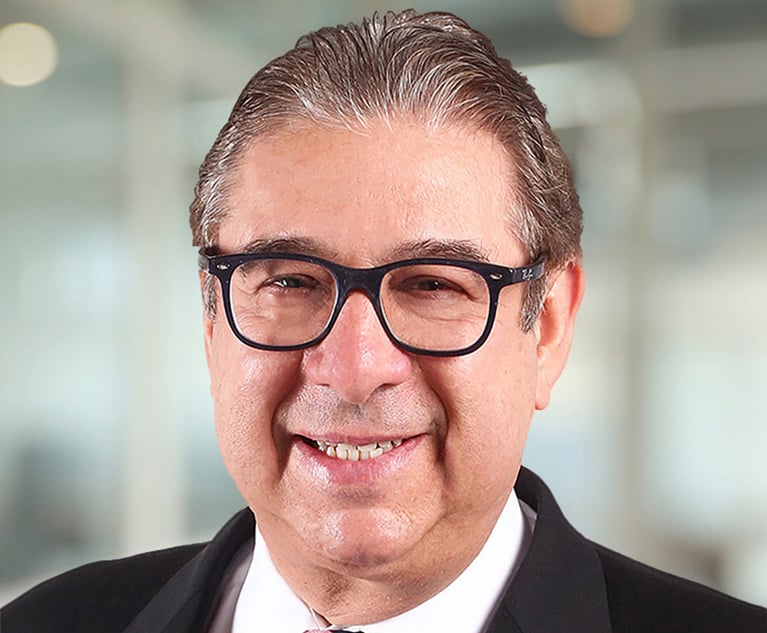

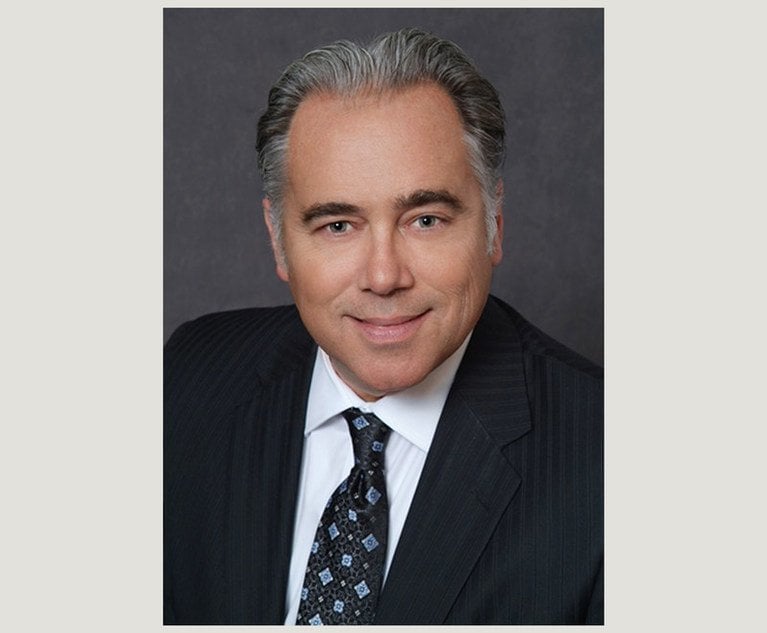

Francis J. Lawall, left, and Kate Mahoney, right, of Pepper Hamiliton.

Francis J. Lawall, left, and Kate Mahoney, right, of Pepper Hamiliton.