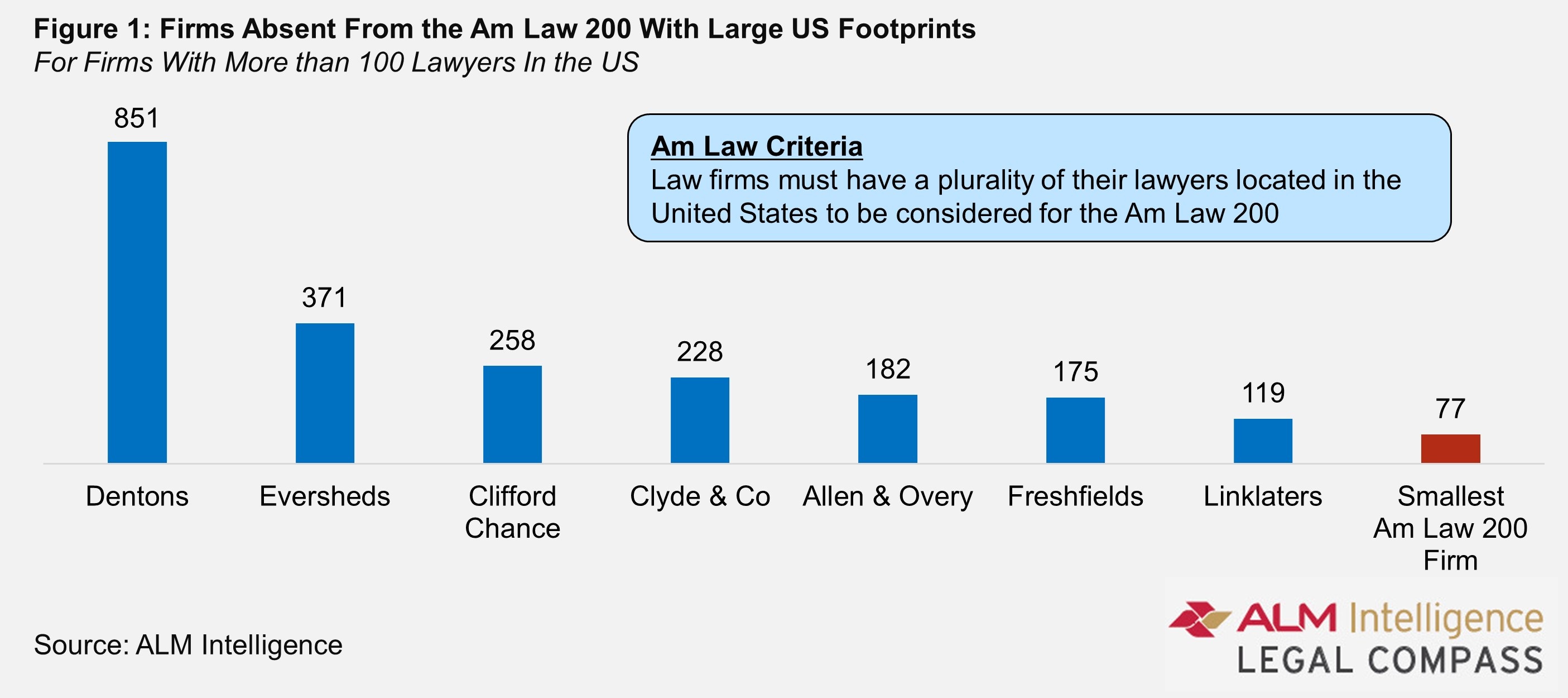

It’s that time of year again, when reports about U.S. firms’ prior-year performance begin to emerge before the annual printing of the Am Law 100 and 200 lists. Absent from those lists are firms that do not meet the full criteria for Am Law inclusion, but would qualify based on their standalone U.S. financial performance. This diverse group of firms (see Figure 1) includes former Am Law 200 firms which no longer meet the Am Law criteria (like Dentons), global firms based outside the U.K. (like Clyde & Co and Eversheds Sutherland), and four firms within the U.K.’s prestigious Magic Circle group. All of these firms have large U.S. footprints and U.S. practices which could rival Am Law firms in revenue and profitability. Typically though, we hear very little about the U.S. practices of these firms. The reason for this is simple – most of these firms don’t provide much clarity into the performance of their U.S. practices. In this regard, Clifford Chance is unique.

As with most firms of its size, Clifford Chance publishes its global financial results each year. Unlike most firms, however, it also releases a breakdown of the firm’s financial performance in each global region. In addition to these public disclosures, Clifford Chance went one step further this year. The firm provided ALM Intelligence with data on the growth and profitability of its Americas practice since 2010. An analysis of that data provides useful insight into the firm’s performance in the U.S. It also raises questions about the long-held belief that U.K. firms have struggled to develop a sustainable footprint in the U.S. Clifford Chance’s U.S. footprint certainly looks sustainable – perhaps even thriving.