In the largest-ever settlement between the U.S. government and a single company, Bank of America Corp. on Thursday agreed to pay $16.6 billion in penalties and consumer relief for selling toxic mortgage-backed securities—a sum that will include approximately $800 million in cash payments and relief for New York consumers.

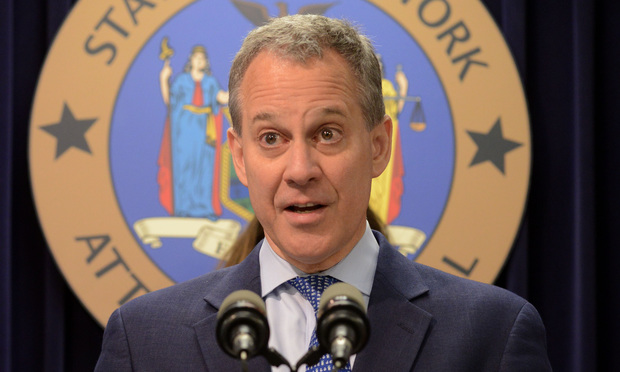

The bank “knowingly, routinely, falsely, and fraudulently marked and sold these loans as sound and reliable investments,” said Attorney General Eric Holder at a news conference at the U.S. Department of Justice headquarters. “Worse still, on multiple occasions—when confronted with concerns about their reckless practices—bankers at these institutions continued to mislead investors about their own standards and to securitize loans with fundamental credit, compliance, and legal defects.”