ALBANY – A prominent Manhattan art dealer is not entitled to a refund of the state taxes he paid on the $2.5 million sale of an oil painting that turned out to be a sophisticated forgery, an administrative law judge has determined.

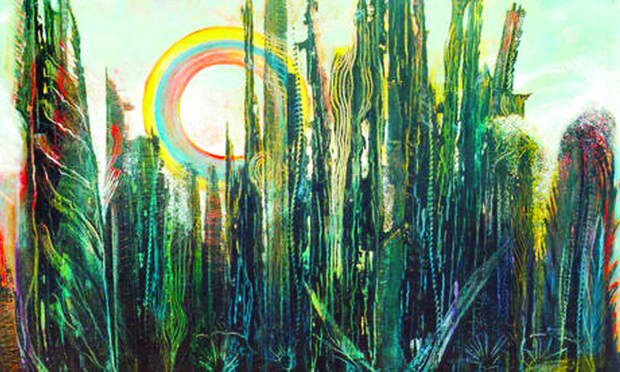

While not responsible in any way for the fake Max Ernst painting sold under the name “La Forêt,” dealer Richard Feigen was deemed ineligible for a $215,625 sales tax refund because he filed too late to qualify under state Tax Law §1139(c), Division of Taxation ALJ Winifred Maloney decided.