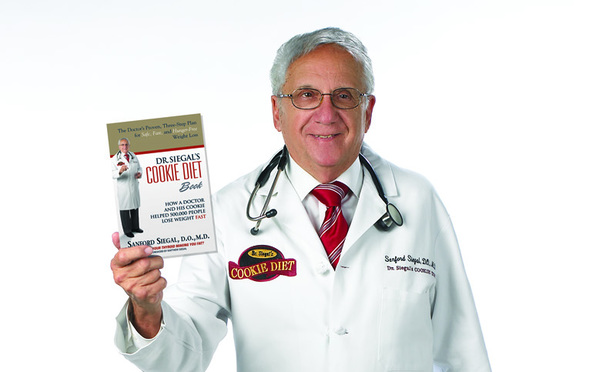

The case of the doctor who wants to avoid paying a $2.9 million judgment in a dispute over stale diet cookies came before the Third District Court of Appeal on Tuesday.

Dr. Siegal’s Direct Nutritionals LLC, better known to consumers as “The Cookie Diet,” argued it shouldn’t have to reimburse Walgreen Co. for the cookies the drugstore chain was unable to sell.