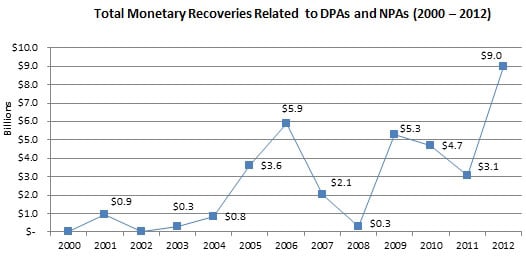

With Congress so worried about the national budget these days, maybe it should take fiscal tips from the U.S. Department of Justice. Federal enforcers obtained a whopping $9 billion in corporate settlements in 2012a record amount that surpassed the previous high set in 2006 by nearly $3 billion.

I know something about big settlements, said attorney F. Joseph Warin, who has negotiated deals as both a one-time federal prosecutor as well as a private practitioner representing companies. But when you look at this aggregation of numbers, its extraordinaryhundreds of millions of dollars in a whole range of areas.

Warin, chair of the Washington, D.C. litigation department at Gibson, Dunn & Crutcher, said 10 years ago the b word was never discussed. But today, dollar amounts in the billions are almost the new norm.

And like any other legal matter with big numbers, the outcome invites comparison so that each huge settlement conditions the next negotiation, he added.

Among those companies contributing the most to the federal treasury were GlaxoSmithKline, which paid a $3 billion penalty for drug misbranding; HSBC Bank USA, N.A. and HSBC Holdings, with $1.9 billion for money laundering compliance failures and trade sanctions; and UBS AG, with a $1.5 billion fine for fraud.

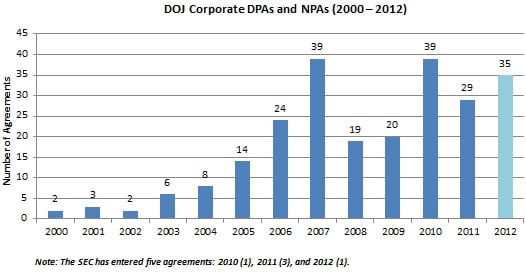

The numbers were compiled as part of Gibson, Dunn & Crutchers annual look at corporate settlements, called deferred and non-deferred prosecution agreements.

The use of the agreements, as opposed to corporate indictments, continues at a near-record pace. There were 35 deals last year; the previous high of 39 was reached in both 2007 and 2010.

Besides penalties, the agreements usually include remediation measures and sometimes require continued corporate monitoring.

Historically the deals were used mainly in the Justice Departments fraud section. But Warin noted the breadth of 2012s settlements.

The continued explosion across the various working units is significant, he said. Theyve essentially become an institutionalized resolution device across a variety of sections, from money laundering to national security to the [Environmental Protection Agency].

He noted that the financial industry took the biggest hit in 2012. Besides HSBC and UBS, the government settled with Barclays Bank for $360 million; BDO USA for $50 million; Diamondback Capital Management for $9 million; Imperial Holdings Inc. for $8 million; ING Bank, N.V. for $619 million; MoneyGram International Inc. for $100 million; and Standard Chartered Bank for $327 million.

Warin expects the trend of more prosecution agreements and higher penalties to continue through 2013.

And what of critics who say the deals dont really deter bad corporate behavior because big companies just consider the fines a necessary cost of doing business?

Thats nonsense, retorts Warin. I am in boardrooms and senior management meetings frequently, and no one perceives these matters as a cost of doing business.

Besides being costly and damaging to a companys reputation, a serious investigation is a huge distraction from the mission of the corporation, Warin said.

It takes up a great deal of senior managements time and energy, he added. So they want compliance systems that help them avoid ever finding themselves in a similar situation again.

Charts provided by Gibson, Dunn & Crutcher.