Richard “Rick” Climan, a well-traveled technology transactions lawyer in Silicon Valley, is preparing to leave Weil, Gotshal & Manges for Hogan Lovells, according to three sources familiar with the matter.

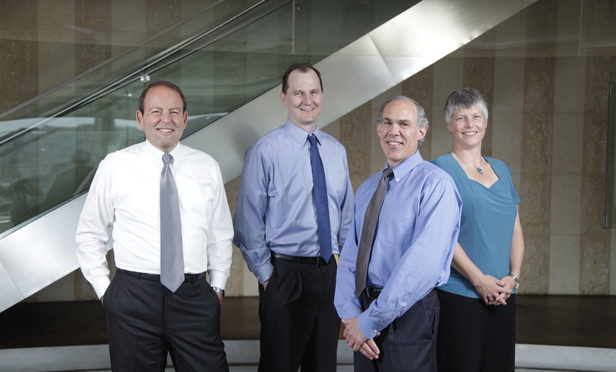

Other lawyers looking to leave Weil with Climan, who is in the final stages of withdrawing from the firm’s partnership, include fellow partners John Brockland, Keith Flaum and Jane Ross. The group headed to Weil nearly five years ago from Dewey & LeBoeuf, a now-defunct firm that the four partners joined from Cooley in two separate moves in 2009.