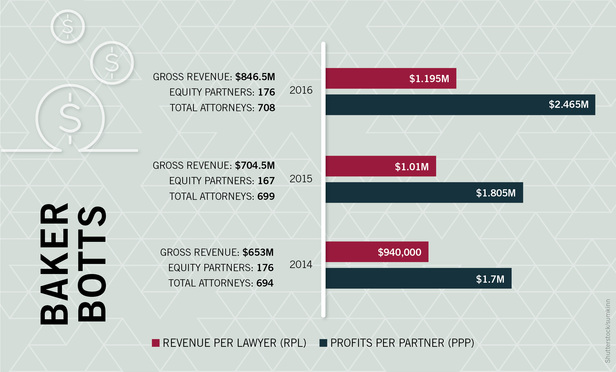

Boosted by some big contingency fees and strategic investments, Houston-based Baker Botts posted a record year in 2016, with revenue up 20.2 percent compared with 2015, and profits per partner up 36.6 percent.

The bottom-line numbers were rosy: Gross revenue hit $846.5 million for 2016, compared with $704.5 million in 2015, and net income reached $435 million, from $301 million the prior year. Profits per partner were $2,465,000 in 2016, up from $1,805,000 in 2015, and revenue per lawyer came in at $1,195,000 in 2016, up 18.3 percent from $1,010,000.