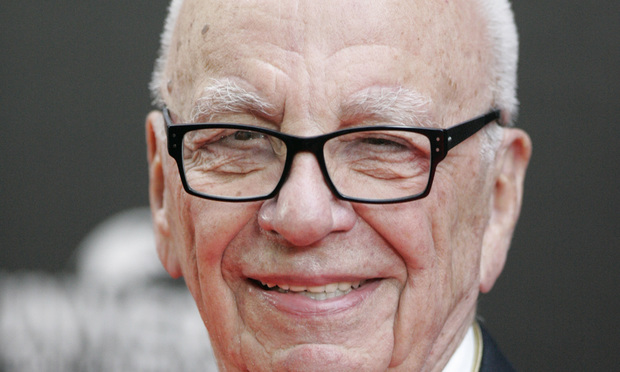

21st Century Fox said on Friday that it would sell its pay-television business in Italy and Germany to British Sky Broadcasting Group for more than $9 billion. The deal would boost media mogul Rupert Murdoch’s financial firepower to renew his unsolicited $80 billion takeover bid for Time Warner.

After two months of negotiations, BSkyB—which is 39 percent owned by 21st Century Fox—agreed to pay 2.9 billion pounds ($4.9 billion) in cash, at a small premium of 6.75 euros ($9.09) per share, for 21st Century Fox’s 57.4 percent stake in Sky Deutschland.