The Milwaukee Bucks concluded the 2013–14 National Basketball Association season Wednesday night with a loss to the Atlanta Hawks that gave the team a league-worst 15-67 record that qualifies as the poorest performance in franchise history.

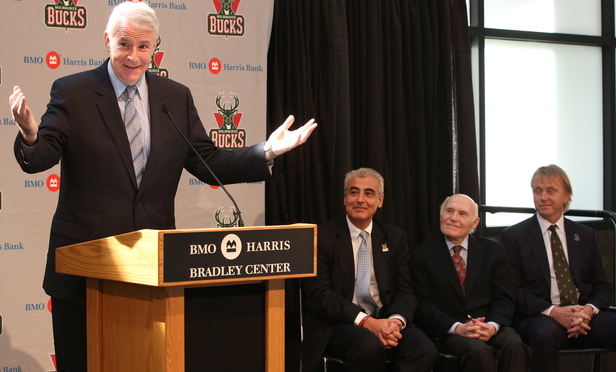

The team fared much better away from the court earlier in the day, as former U.S. Sen. Herb Kohl—who bought the Bucks for just $18 million in 1985—announced that he has agreed to sell the squad to New York financiers Marc Lasry and Wesley Edens for $550 million. Forbes reports that the price is a record sum for the sale of an NBA team.