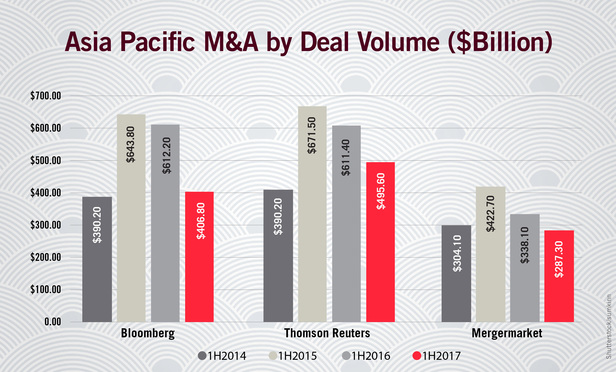

Merger and acquisition activity in the Asia Pacific continued to slow during the first six months of this year, as deal volume dropped to its lowest level in three years.

According to reports published by Bloomberg LP, Thomson Reuters and Mergermarket, deal volume in Asia fell sharply compared to the previous two years.

Rankings by the three organizations, which use different methodologies, did not produce a consensus on a single law firm that advised the most M&A deals by value in the past six months. Simpson Thacher & Bartlett topped Bloomberg’s list with $24.3 billion in M&A deal volume in the Asia Pacific, excluding Japan. The New York firm was followed by China’s Fangda Partners, Clifford Chance and Korea’s Kim & Chang, all totaling more than $20 billion worth of deals in the first half of 2017.

Herbert Smith Freehills won the top spot on Thomson Reuters’ ranking with $22.7 billion, and Clifford Chance followed with $21.5 billion. King & Wood Mallesons kept its top ranking from a year earlier on Mergermarket’s report with $29.5 billion worth of deals; Clifford Chance and Fangda followed, with each handling deals valued at close to $22 billion.